1. disruption (n)

the action of preventing something, especially a system, process, or event, from continuing as usual or as expected

2. statistician (n)

someone who studies or is an expert in statistics

3. deputy (n)

a person who is given the power to do something instead of another person, or the person whose rank is immediately below that of the leader of an organization

4. mortgages (n)

an agreement that allows you to borrow money from a bank or similar organization, especially in order to buy a house, or the amount of money itself

5. services (n)

the particular skills that someone has and can offer to others

6. tracks (v)

to follow a person or animal by looking for proof that they have been somewhere, or by using electronic equipment

Clothes and food price rises push inflation higher

Rises in the cost of clothing and food helped to push UK inflation higher-than-expected last month.

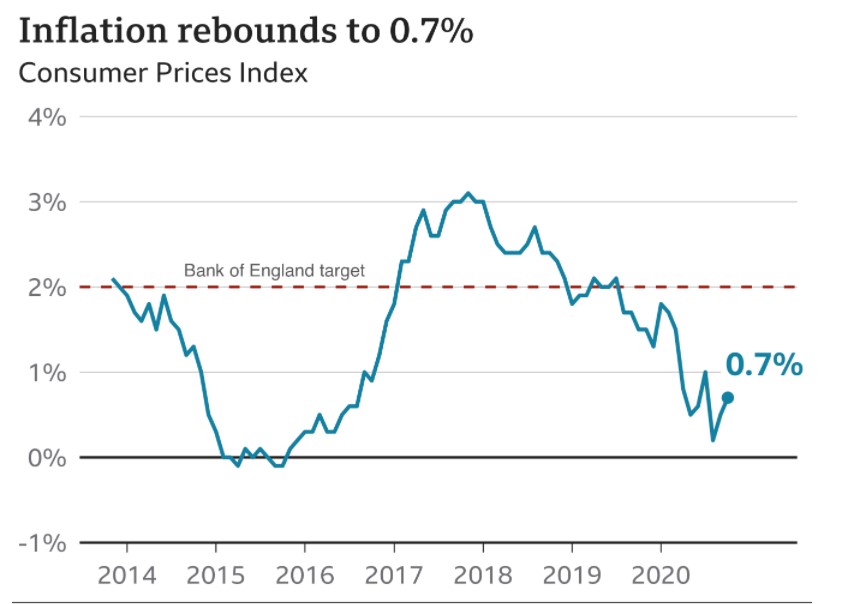

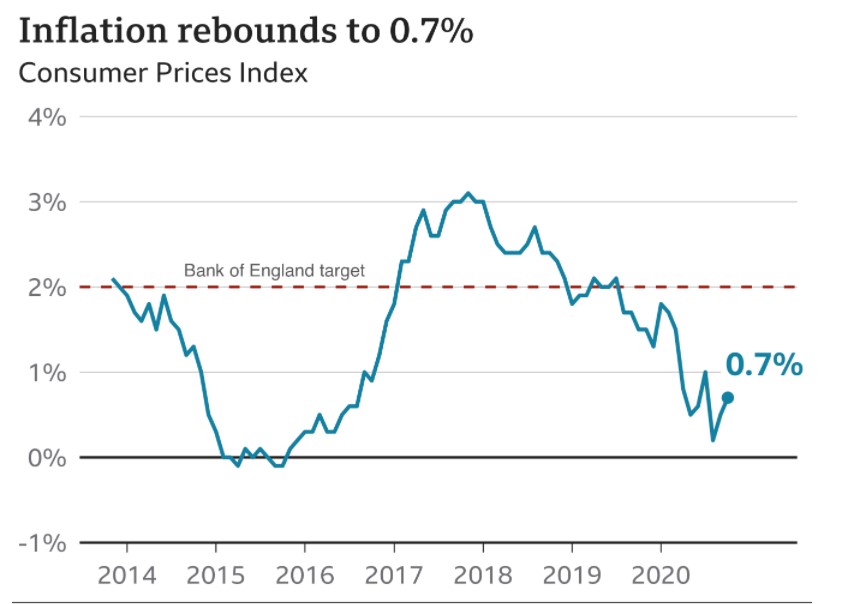

The UK’s inflation rate, which tracks the prices of goods and services, jumped to 0.7% in October from 0.5% in September, official figures show. Second-hand cars and computer games also saw price rises, but these were partially offset by falls in the cost of energy and holidays.

“The rate of inflation increased slightly as clothing prices grew, returning to their normal seasonal pattern after the disruption this year,” said Office for National Statistics deputy statistician Jonathan Athow.

Normally prices for clothes and shoes fall each year between June and July in summer sales before autumn ranges come in, and then rise before sales towards the end of the year, the ONS said.

Throughout 2020 this pattern has been different, with increased discounting in March and April, probably as a response to lockdown, it said. After a small increase in July and August, prices rose by more than a year ago.

Second-hand car prices also rose in October as people tried to reduce their reliance on public transport.

Inflation is the rate at which the prices for goods and services increase. It affects everything from mortgages to the cost of our shopping and the price of train tickets.

It’s one of the key measures of financial well-being, because it affects what consumers can buy for their money. If there is inflation, money doesn’t go as far.

Resource:https://www.bbc.com/news/uk-54984097

- Is inflation a problem in your country?

- Have you ever suffered from a serious cash shortage?

- Has there ever been chaos and poverty in your country?

- What would you do if there was no food in the shops?

The Federal Reserve has an official commitment to two different policies. One is to prevent inflation from getting too high. The second is to maintain high employment... the European Central Bank has only the first. It has no commitment to keep employment up.

Noam Chomsky

Advanced

Advanced